We are…

Doing Business

EDC’s Expert Services

We are committed to attracting, growing and retaining business and industry for Elkhart County, Indiana. Our services include:

- Operational Cost Analysis

- Incentive Comparisons

- Workforce Surveys & Research

- Research & Support for State and Local Tax Structures

- Connections to Key Resources

- Project Management

EDC Tools & Resources

Our team is responsible for the recruitment, retention and economic vibrancy of business and industry in Elkhart County, Indiana. The team provides concierge services by removing barriers for business, utilizing county as well as state programs.

Training / Workforce Development

Assistance in Locating Certification Programs

We work with local educational institutions to help you increase your workforce’s productivity and to prepare them to become part of the next generation of Indiana’s workforce.

Elkhart Career Center Partnership

Students with a wide range of professional interests can take advantage of the opportunity to get a jump start on their futures at the Elkhart Area Career Center. The ECC provides college level and vocational training to high school and adult students to develop the next generation of skilled trades workers.

Elevate Ventures

Provides strategic sales planning, market research and leadership assessment for second-stage companies that have the intent and capacity to grow their business with sales from outside of Indiana.

Indiana University South Bend – Elkhart Partnership

IUSB provides diverse faculty and student business assistance to assist local business in being more competitive in today’s economy.

Ivy Tech Partnership

Ivy Tech Community College prepares Indiana residents to learn, live, and work in a diverse and globally competitive environment by delivering professional, technical, transfer, and lifelong education.

Purdue Manufacturing Extension Partnership

The Purdue Manufacturing Extension Partnership leverages resources in both the public and private sectors to help companies identify areas of improvement, streamline processes, and ultimately increase competitiveness. Click for details: Purdue Manufacturing Extension Partnership

180 Skills Training Program for Indiana Residents

In partnership with 180 Skills, the State of Indiana is making skills training resources available to Indiana employers. Learn more

Business Site Assistance

The EDC recruits new businesses to Elkhart County, supports the growth of existing businesses, and facilitates workforce attraction and retention. We utilize comprehensive, leading edge Geographic Data tool as a framework for gathering, managing, and analyzing data. Click here to access our GIS Tool

Company NetworkingThe EDC of Elkhart connects businesses that may not be already working together on sales and service partnerships.

Local Incentives

County Real Estate Tax Phase in Real Property Tax Phase-in

New buildings constructed are eligible for real property tax abatement. Substantial improvements to existing buildings may be eligible, but it is important to note that only the value of the improvement to the existing building qualifies. Land does not qualify for phase-in. Real property tax phase-in is a declining percentage of the increase in assessed value of the improvement.

Personal Property Tax Phase-in

Manufacturing and research & development equipment new to Indiana is eligible for personal property tax phase-in. Personal property tax phase-in is a declining percentage of the assessed value of the newly installed manufacturing and / or research and development equipment.

Vacant Property Tax Phase-in

One or two year tax phase-in based on the occupation of a qualifying vacant building.

Elkhart Urban Enterprise Zones

Businesses located within the Enterprise Zone annually receive tax incentives from the state of Indiana for hiring Zone residents. A portion of those incentives are then shared with the EUEA to promote further economic development and employment opportunities within the EZ. Learn more at Elkhart Urban Enterprise Zone

Small Business Administration Hub Zone

HUBZone is an underutilized United States Small Business Administration (SBA) program for small companies that operate and employ people in Historically Underutilized Business Zones (HUBZones). The HUBZoneprogram was created in response to the HUBZone Empowerment Act created by the US Congress in 1998 and the EDC of Elkhart County is available to assist businesses in utilizing this program.

Corporate Income Tax

The Indiana State corporate income tax rate was as high

as 8.50% in 2012 and have worked hard reducing that

rate to 4.9% today.

- No inventory tax

- Right-to-Work State

Economic Development for a Growing Economy Tax Credit (EDGE)

Provides incentive to businesses to support jobs creation, capital investment and to improve the standard of living for Indiana residents. The refundable corporate income tax credit is calculated as a percentage (not to exceed 100%) of the expected increased tax withholdings generated from new jobs creation. The credit certification is phased in annually for up to 10 years based upon the employment ramp-up outlined by the business.

HBI Hoosier Business Investment Tax Credit

The Hoosier Business Investment (HBI) Tax Credit is the IEDC’s primary capital investment tool. The HBI tax credit provides an incentive to businesses to support job creation and capital investment that improves the standard of living for Indiana residents. The nonrefundable income tax credits are calculated as a percentage of the eligible capital investment to support the project. The credit may be certified annually, based on the phase-in of eligible capital investment.

Industrial Development Grant Fund

The Industrial Grant Fund (IDGF) provides assistance to municipalities and other eligible entities as defined under I.C. 5-28-25-1 with off-site infrastructure improvements needed to serve the proposed project site. Upon review and approval of the Local Recipient’s application, project specific Milestones are established for completing the improvements. IDGF will reimburse a portion of the actual total cost of the infrastructure improvements. The assistance will be paid as each Milestone is achieved, with final payment upon completion of the last Milestone of the infrastructure project

RTC REDEVELOPMENT TAX CREDIT

The Redevelopment Tax Credit (RTC) provides an incentive for investment in the redevelopment of vacant land and buildings as well as brownfields. This credit, established by Indiana Code § 6-3.1-34, provides companies and developers an assignable income tax credit for investing in the redevelopment of communities, improving quality of place and building capacity at the local level. The IEDC may not award more than $50 million in credits each state fiscal year. Any credit award over $7 million must include a requirement that a portion of the credit be repaid by the company or developer.

Headquarter Relocation Tax Credit

The Headquarters Relocation Tax Credit (HQRTC) provides a nonrefundable tax credit to a business that relocates its headquarters to Indiana. The credit is assessed against the corporation’s state tax liability. The HQRTC is established by Indiana Code § 6-3.1-30.

Data Centers Sales Tax Exemption

Capital Investment Incentive

The Data Center Gross Retail and Use Tax Exemption provides a sales and use tax exemption on purchases of qualifying data center equipment and energy to operators of a qualified data center for a period not to exceed 25 years for data center investments of less than $750 million. If the investment exceeds $750 million, the IEDC may award an exemption for up to 50 years. This program is established by Indiana Code § 6-2.5-15. Local governments may also provide a personal property tax exemption on qualified enterprise information technology equipment to owners of a data center who invest at least $25 million in real and personal property in the facility.

CRED Community Revitalization Enhancement District Tax Credit

The Community Revitalization Enhancement District (CRED) Tax Credit provides an incentive for investment in community revitalization enhancement districts (Indiana Code 36-7-13). The credit is established by Ind. Code 6-3.1-19. Please note that the CRED tax credit is not the same as the CRED financing tool established under Indiana Code 36-7-13. Revenue oversees these incentive programs.

Skills Enhancement Fund Workforce Training Grant

The Skills Enhancement Fund (SEF) provides assistance to companies to support training of employees required to support business growth in Indiana. The grant may be provided to reimburse a portion (typically 50%) of eligible training costs over a period of two full calendar years from the commencement of the project. Grants from the Skills Enhancement Fund may only support training that leads to a post-secondary or nationally-recognized industry credential, or is specialized company training. If the training is provided to an existing employee, the company must also provide an increase in wages. Specialized company training should meet the applicable industry standard or be administered by a third party.

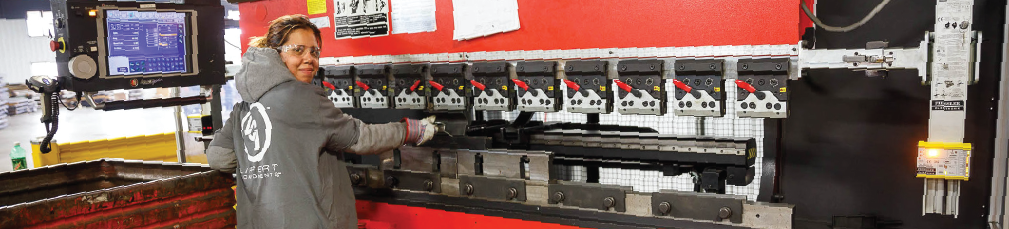

Major Employers

Our employers help to define our community. Elkhart County is home to a variety of business and industry that comprise a diversified and dynamic economic base. Elkhart County boasts opportunities in advanced manufacturing, healthcare, transportation, government, education and more.

Leading Elkhart County Employers

Business Name

Thor Industries, Inc.

Forest River, Inc.

Lippert Components, Inc.

Patrick Industries

Winnebago

Beacon Health System

Elkhart Community Schools

Gulf Stream Coach, Inc.

Goshen Community Schools

Utilimaster

Supreme Industries by Wabash

Elkhart County Government

Martin’s Supermarkets

Masterbrand Cabinets, Inc.

Bennington Marine

Voyant Beauty (Formerly KIK Personal Care)

Goshen Health

East to West & North to South RV

Norfolk Southern Railway Company

Industry

Manufacturing

Manufacturing

Manufacturing

Manufacturing

Manufacturing

Educational Services

Health Care

Manufacturing

Educational Services

Manufacturing

Manufacturing

Government

Retail

Manufacturing

Manufacturing

Manufacturing

Health Care

Manufacturing

Transportation

# of Employees

13,622

10,000

7,500

3,500

2,754

1,800

1,517

1,500

1,442

1,300

1,200

1,021

900

850

804

735

800

615

425